When discussing insurance coverage, many people wonder about the diverse range of professions and services that can be covered. One such question often asked is, “Does insurance pay for butchers?” The answer depends on the type of insurance involved and the specific context of the question. In this article, we’ll break down the scenarios where insurance may apply to butchers, Insurance Pay for Butchers whether for their professional needs or unexpected damages caused by their services.

Understanding the Role of Insurance in a Butcher’s Profession

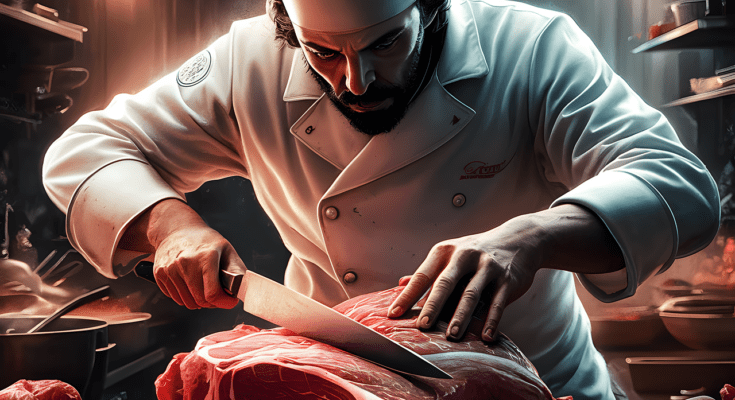

Butchers, like any other professionals, face risks in their line of work. Insurance Pay for Butchers These risks can range from workplace accidents to liabilities involving their products. Here’s how different types of insurance can come into play:

1. Business Insurance for Butchers

Butchers typically run small businesses, whether independently or as part of larger establishments. A comprehensive business insurance plan can cover a variety of potential issues:

- Property Damage: Insurance can pay for damages to the butcher shop, such as fires, floods, or vandalism.

- Equipment Breakdown: Refrigeration units and meat-cutting tools are essential for butchers. If these break down, insurance can cover repair or replacement costs.

- Stock Coverage: Butchers deal with perishable goods, Insurance Pay for Butchers and insurance can cover losses due to spoilage caused by power outages or refrigeration failure.

2. Liability Insurance for Butchers

Liability insurance is crucial for butchers to protect against claims arising from:

- Food Safety Issues: If a customer falls ill due to spoiled or contaminated meat sold by the butcher, liability insurance can cover legal and medical expenses.

- Accidental Injuries: Customers injured on the premises, such as slipping on a wet floor, can file claims that this insurance type will address.

3. Workers’ Compensation Insurance

If a butcher employs staff, workers’ compensation insurance is often legally required. It pays for medical bills and lost wages if an employee gets injured on the job, Insurance Pay for Butchers such as cutting themselves while handling meat.

Read More About Website: https://www.hiscox.co.uk/business-insurance/butcher

Does Health Insurance Cover Butchers?

From a different perspective, individual butchers may wonder if their health insurance covers injuries sustained at work. The answer largely depends on whether the injury is work-related:

- Work-Related Injuries: Typically, these are covered by workers’ compensation, not health insurance.

- Non-Work-Related Injuries or Illnesses: Health insurance would cover treatment, as it applies to general health issues.

Does Insurance Pay for Butcher Services?

If you’re a consumer wondering whether your personal insurance will pay for butcher services, the answer is usually no. Insurance policies like health, home, or auto insurance do not cover routine purchases or services from butchers. However, some niche insurance policies, such as food spoilage coverage within home insurance, might indirectly involve a butcher’s products if stored meat spoils during a power outage.

Also Read In This Article: Does Farmers Insurance Operate in Canada?

The Importance of Choosing the Right Coverage

For butchers, having the right insurance coverage is essential to ensure financial stability and protection from unexpected liabilities. Insurance Pay for Butchers Here are some tips for selecting the best insurance policy:

- Evaluate the specific risks of your business (e.g., high-value equipment, liability risks).

- Compare policies from multiple insurers to find the most comprehensive coverage.

- Work with an insurance broker familiar with small business or food industry needs.

Conclusion

In summary, insurance can indeed pay for butchers in specific contexts. For butchers themselves, having the right types of business, liability, and workers’ compensation insurance ensures they are covered against potential risks. For consumers, Insurance Pay for Butchers insurance typically does not pay for services provided by butchers but may cover damages involving butchered products under certain circumstances.

Whether you’re a butcher or a customer, understanding the relationship between insurance and the meat industry can help you make informed decisions about coverage and risk management.